Irrational Markets: Hold Onto Your Hat…And Wallet

In the 1983 Berkshire Hathaway shareholder letter, Warren Buffett wrote:

“A hyperactive stock market is the pickpocket of enterprise.”

The investment game is about making managed bets. The more we can correctly predict how the price of an investment will grow, the easier placing those bets profitably will be.

In times of uncertainty or new technological innovation (hello web3!), volatility of pricing makes it extremely difficult to place profitable bets and often serves as a means of wealth transfer (aka picking pockets) rather than wealth creation.

So, what exactly is volatility anyway?

Volatility is a measure of how much the price of a financial asset varies over time. It is a concept that represents both risk and opportunity for financial investments whose value on any given day may go up or down substantially.

Sure, highly volatile investments might bring 100x returns, but they can also cause sleepless nights and ulcers because we cannot predict with any certainty where the price might trend.

Buffett invested in things like chocolate and Coca-Cola precisely because they were boring. He relied on management to steadily increase profits over time which would lead to a fairly predictable increase in share price as a result.

Even with his own firm Berkshire Hathaway, Buffett preferred that shares trade at low volume. If buyers internalized the value they were holding, no shares would ever trade on the open market because there would be no sellers!

Buffett hoped the intrinsic value of the stock was evident in its price, and never wanted share value to seem overpriced or overhyped.

In contrast, ever since Satoshi Nakamoto introduced the world to Bitcoin, cryptocurrency markets have been subject to wild swings and hyperactivity. As a result, price charts look like a tidal wave.

Wildly high or wildly low pricing tends to produce manic buying and selling, leading capital to flow out of impatient wallets and into those with a more tempered demeanor.

Pay attention to the hype and fervor within your own portfolio as well as the broader marketplace.

Here are some startling facts about just how volatile Bitcoin has been over time:

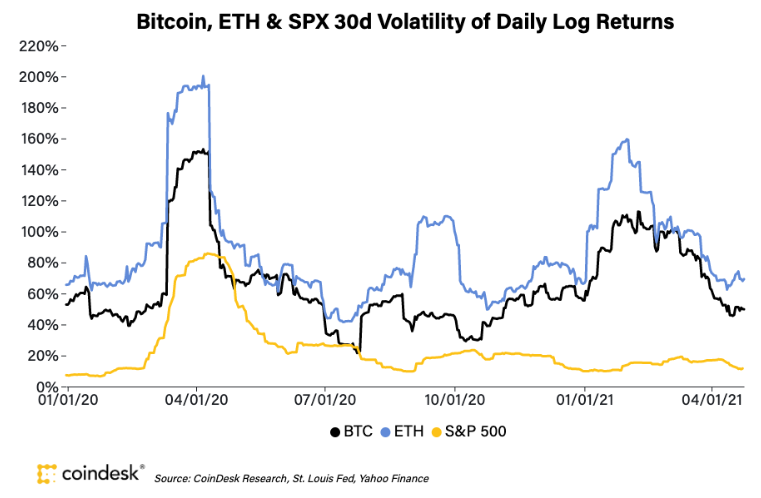

Bitcoin is 2.4x more volatile than the S&P 500.

Bitcoin is almost 3x more volatile than the NASDAQ.*

Bitcoin has been at times 10x more volatile than the EUR/USD, the world’s most traded currency.**

Bitcoin is more volatile than any security listed on an American stock exchange.

For comparison, the volatility of gold averages around 1.2%, while other major currencies average between 0.5% and 1.0%.

The crazy part? Bitcoin is the BORING one in web3! Every other token in the ecosystem measures at higher volatility than Bitcoin.

If you found this post interesting, give us a follow. And stay tuned for more Warren Wednesdays featuring excerpts from our book, Warren Buffett in a Web3 World.

We took over 1,000 pages of wisdom from the Oracle of Omaha and condensed it into a snackable, easy-to-read investment guide to help you on your journey to grow wealth in the web3 space!

* https://buybitcoinworldwide.com/volatility-index/

** https://medium.com/swissquote-education/bitcoin-vs-risk-understanding-volatility-472efe96e439