Web3’s Breathtaking Pace of Economic Change

In the 1981 Berkshire Hathaway shareholder letter, Warren Buffett wrote:

“When change is slow, constant rethinking is actually undesirable…But when change is great, yesterday’s assumptions can be retained only at great cost. And the pace of economic change has become breathtaking”

For most of us, one month in the web3 world feels comparable to a full quarter or more in a traditional business environment. Buffett’s reference to the pace of change is even more true today than when he wrote those words more than thirty years ago.

Indeed, the pace of change in the web3 space is like nothing we’ve seen before. Just google “top 10 crypto tokens of 2017” and you’ll get a sense of what I mean.

Buffett gives us two lessons with this maxim that we can apply to the web3 space:

LESSON 1

First, during “crypto winters,” investors should pick their horses and hang on for the ride.

Rethinking your position or selling in and out of projects when liquidity and interest are low will likely lead to underperformance coupled with tax inefficient activity. This is particularly good advice if you’re anything like me and have a predisposition to get right back into a position if you sell an asset.

During the bear market of 2022, the majority of prices for well known assets remained stable and stagnant. This is good news for long-term HODLERS, but can be tough to stomach if you have itchy trading fingers.

Bottom line: When things are slow, go outside, get some fresh air, and spend time with family. Keep long positions until the market heats back up before making decisions to change allocations.

LESSON 2

Buffett’s second lesson is that during times of hype and fervor it likely makes sense to reevaluate holdings based on shorter time horizons.

When things heat up and there is a new favorite trend facing the market, investors need to be ready to pounce on opportunities but also keep their finger on the pulse of the changing environment.

A great example of this was the proliferation of generative NFT projects in 2021. Prior to fervent market adoption, many investors would not have considered taking an investment in a profile picture of a Punk, Ape, or Goblin, but here we are!

As an asset class, NFTs are expected to reach hundreds of billions of dollars by 2030. With the surge of evolving utility and technology (e.g. Ordinals) it will be difficult to take longer-term positions without knowing who the real winners in the space will be.

Bottom line: When activity speeds up, and the greed/fear indexes start to glow green, stay flexible with new information and be ready to pivot assumptions around “value.”

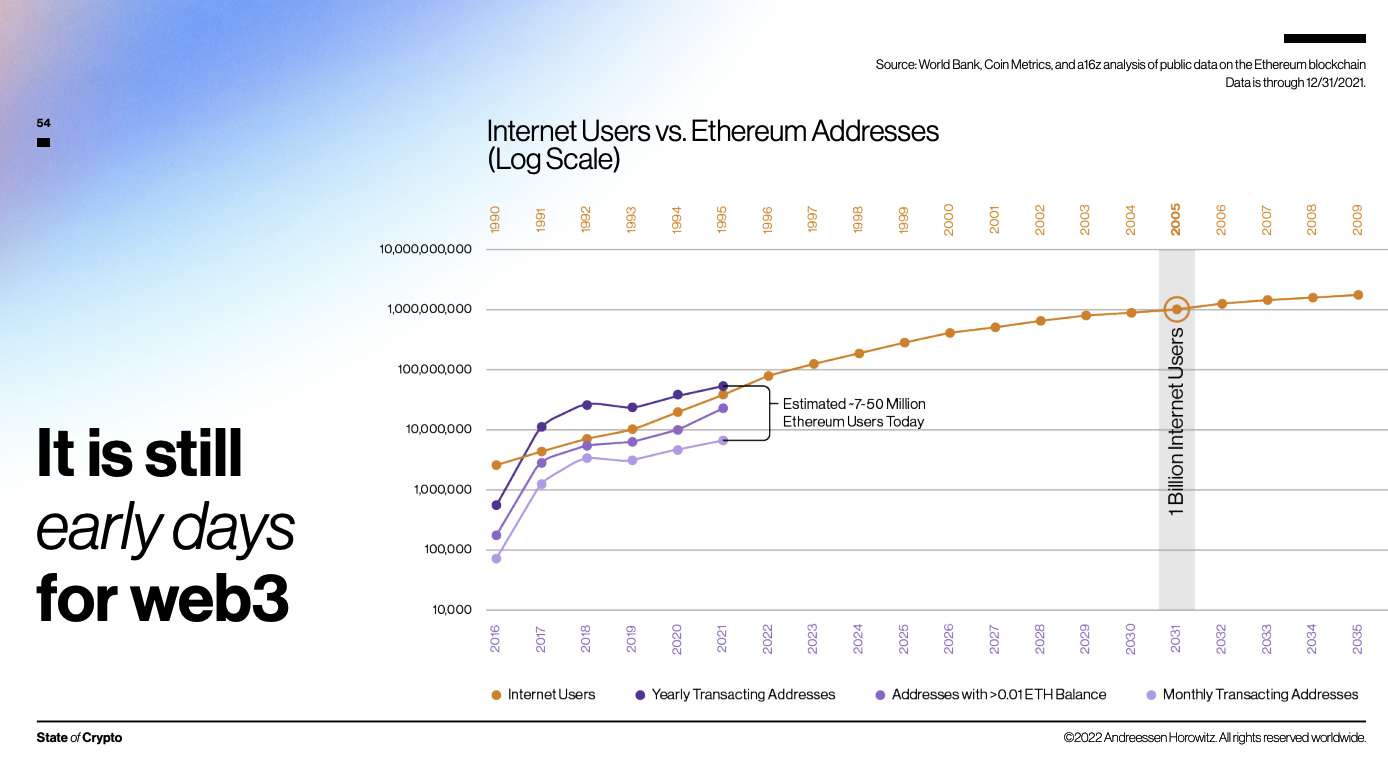

The future is faster than we think. The convergence of web3 technologies will usher in a pace of change like we’ve never seen before. The good news? We are still very much in the early days.

If you found this post interesting give us a follow and stay tuned for more Warren Wednesdays featuring excerpts from our book, Warren Buffett in a Web3 World.

We took over 1,000 pages of wisdom from the Oracle of Omaha and condensed it into a snackable, easy-to-read investment guide to help you on your journey to grow wealth in the web3 space!