Management Matters: What Do You Know About the Founders?

In the 1982 Berkshire Hathaway shareholder letter, Warren Buffett wrote:

“Once management shows itself insensitive to the interest of owners, shareholders will suffer a long time from the price/value ratio afforded their stock.”

If you are a credible builder in web3, chances are that you’re doxxed the public knows who you are, what you look like and what you stand for. Many leverage their profile picture (PFP) as a means of digital identity and a way to stand in solidarity with their project or community.

When it comes to investing however, the ability to identify a particular founder or team is critical. Let me be clear, if you are interested in investing in a web3 project and the founder slide looks like this…

…please consider looking for other options.

Buffett picked winning businesses by picking winning management. His philosophy wasn’t tied to investing in companies but to investing in people and the teams managing those companies. Although this observation is forty years old, we should remain emphatic in aligning investments with talented management.

Today, getting these details is easier than ever before. Leverage social platforms like Twitter and Discord to get a clear picture of the team leading a project before sending off your hard-earned investment dollars.

Bonus points if you can find and connect with them on LinkedIn.

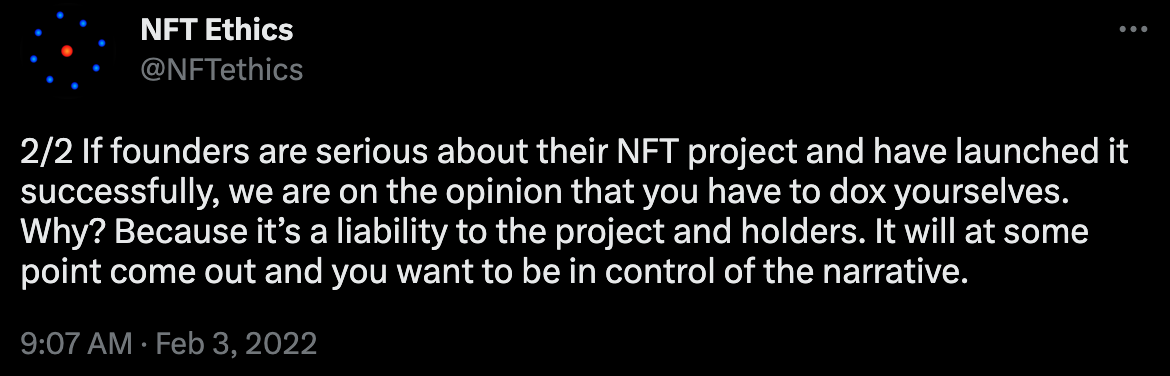

Our friends @NFTEthics bring up some valid points to consider as well…

Be sure to analyze what these leaders are saying outside of their project — how they view risk and value the community. If they have spent time on the road speaking at conferences or grinding in Twitter spaces, it’s likely that they are legitimate players looking to advance the ecosystem; not rug the project.

As popular platforms and projects emerge, founders are being compelled by their communities to dox themselves as a way to instill trust in the trustless environment of web3. The founders behind the Blur NFT marketplace, DeGods and y00ts NFT collections are great examples.

If you can’t find substantial positive info, pass. If they are undoxxed, pass.

A quick disclaimer…just because you CAN identify who leads the project does NOT automatically mean it will be a success. Knowing the identities of Sam Bankman-Fried or the executives at Silicon Valley Bank didn’t prevent disaster.

Always remember that you can do the research and due diligence, but nothing can protect your investment from outright fraud, malfeasance, or poor business decisions by company management. But getting as much information as you can will best position you for success.

If you found this post interesting, give us a follow. And stay tuned for more Warren Wednesdays featuring excerpts from our book, Warren Buffett in a Web3 World.

We took over 1,000 pages of wisdom from the Oracle of Omaha and condensed it into a snackable, easy-to-read investment guide to help you on your journey to grow wealth in the web3 space!