Want to Get Rich in Web3? Go Whale Watching.

In the 1983 Berkshire Hathaway shareholder letter, Warren Buffett wrote:

“Good investment ideas are rare, valuable and subject to competitive appropriation.”

As Berkshire Hathaway’s success grew, astute investors began mirroring Buffett’s trading activity. In this quip he is referring to the idea that he is keeping some material information regarding his investment strategies close to the vest.

However, trying to mimic Buffett’s moves came with a long lead time. Most people had to wait for Berkshire Hathaway’s yearly shareholder letter before they could assess Buffett’s strategy.

The same is not the case when investing in web3 where social media tools like Twitter allow users to promote trading strategies and arbitrage opportunities at blazing speeds.

When an opportunity comes across your feed ask yourself how many other people have seen this before me and already taken the steps to capitalize. Chances are you might already be too late, and before you know it, you’ll be someone’s exit liquidity on the way down.

In the web3 space, we follow the money all the time but probably don’t recognize it.

For many retail investors, this was their first chance to participate in the direct funding of highly anticipated decentralized companies.

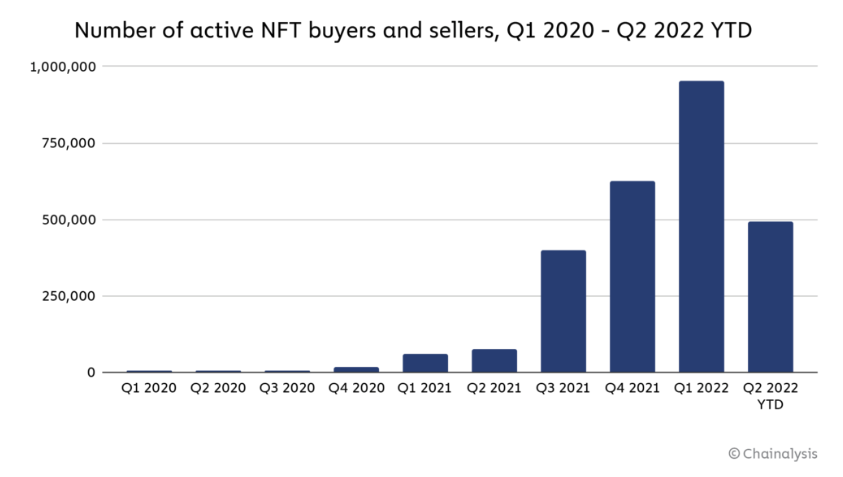

We did in 2017 with the proliferation of ICOs and we followed the money again in 2021 with the domination of NFT projects.

This was an easy way for the average Josephine to participate in the funding of new organizational projects. Early investors grew wealthy in the process of following those trends, but many who followed a little too late were left holding the bag.

A critical benefit of cryptocurrencies and NFT projects is that the intrinsic transparency of blockchains makes tracking the investments of whales and other experienced players easy and instant.

Savvy investors should seek out tracking platforms to gain trading insights for various web3 projects so they can follow the big money with potential opportunities appropriate to those trading strategies before the masses.

For those looking to do some Whale Watching, below we’ve listed 3 free resources for monitoring the activities of the most prolific crypto wallets, i.e. “whales,” in case you want to try emulating their strategies.

Arkham is a free analytics platform (in beta) that makes it easy to track crypto wallets, like those belonging to DAOs, influencers, major traders, and more. Arkham is a great platform for finding whales that got in on certain tokens early and then sold for much higher later.

Impersonator enables users to log in to web3 applications by impersonating any Ethereum address through WalletConnect. While the platform doesn’t permit any transactions (no private keys) users can enter specific wallets (e.g., vitalik.eth), to obtain a firsthand view of recent crypto activities!

Context is a platform that also enables you to monitor the NFT activities of targeted crypto wallets, ensuring that you always stay up-to-date with the newest NFT happenings from people you care about — through the platform's feed stream or navigation bar.

If you found this post interesting, give us a follow. And stay tuned for more Warren Wednesdays featuring excerpts from our book, Warren Buffett in a Web3 World.

We took over 1,000 pages of wisdom from the Oracle of Omaha and condensed it into a snackable, easy-to-read investment guide to help you on your journey to grow wealth in the web3 space!